Looking for a way to accept payments directly on your membership site? Use a payment processor.

If you want to accept money from members, you will need a way to process those payments. Ideally, you want to offer an easy way for members to make payments on your membership site while ensuring top-notch security. This makes your brand look more professional and encourages more people to become paying members.

In this article, we’re going to cover everything you need to know about choosing a payment processor for your membership site and look at some of the best payment processor options available.

A COMPLETE STEP-BY-STEP CHEATSHEET

TO CREATING, LAUNCHING & GROWING A SUCCESSFUL MEMBERSHIP WEBSITE

Factors to consider when choosing a payment processor

You need to keep a few things in mind when choosing a payment processor for your business. When looking at various options, it can be easier to decide on the right one if you know what features and factors to look for in a payment processor.

#1. Revenue

One of the significant factors when deciding on a payment process is knowing what kind of money your business will be dealing with. This means you need to ask yourself if your payment processor can easily handle the number of payments your membership site receives.

For instance, if you generate over $10,000 in revenue each month and your payment processor struggles to keep up with processing all payments, you might need to use another payment processor for your membership site. Otherwise, you will lose money for your business as your payment processor can barely keep up with your brand’s revenue goal each month.

Similarly, if your membership site doesn’t generate enough revenue, there’s no need to upgrade or change your payment processor. You don’t want to be paying more for a payment processor that you don’t actually need if your membership site doesn’t see much sales.

However, using a payment processor that scales as your business grows is a great idea. This means that when you boost sales, you want your payment processor to be able to handle the increased number of sales or payments, so it doesn’t harm the growth of your business and is future-proof.

#2. Fees and costs

If you’re using any payment processor that handles all payments on your membership site, you will have to pay some fees per transaction or a subscription fee if you’re using a more premium plan.

This means you also need to consider if the payment processor you decide to use charges extra fees for processing more significant amounts of payments. For instance, if you offer a yearly subscription plan on your membership site, you will receive a more significant sum of money from users when they subscribe. Depending on your payment processor of choice, you will have to pay a hefty transaction fee or extra to process those payments. This is why it’s essential to consider all fees and costs associated with your choice of payment processor and see if it fits with your business model.

Additionally, you need to consider if your payment processor lets you accept more significant sums of payments as it’s something your business might need in the future. You don’t want your audience to pay for a yearly premium subscription plan only to find out that their payments aren’t processed, and they weren’t able to subscribe to your package. This results in a loss of sales and projects a poor brand image.

#3. Subscription options

Most membership sites have multiple subscription options to let customers choose the payment plan that suits their budget and personal requirements. However, this also means your payment processor should support the subscription options you want to offer to your audience.

For example, if you want to offer a monthly subscription plan while also being able to charge an extra sign-up fee that covers all fees and costs associated with processing the payment, your payment processor of choice will have to support such subscription options. Similarly, if you want to offer recurring payments on your membership site, you will need to use a payment processor that fully supports recurring payments from your audience.

It’s also recommended to simply ask the support team about your desired payment process if it can support the subscription options you want to offer on your membership site. This can save you the headache of dealing with payment issues on your membership site in the future and makes it easier to set up pricing options according to your brand’s strategy.

#4. Security features

Since you’ll be collecting sensitive payment information from your audience when they subscribe, you also need to consider the security features your payment process offers and make the whole experience secure for your audience. This helps encourage more purchases on your membership site and puts out a more professional brand image.

Besides your payment processor supporting security features, you also need to consider how adequately your membership site is secured. Ideally, you want to get an SSL certificate for your membership site, so it’s much more secure to route subscribers to external pages from your own site. This way, users can pay using an external service without having to worry about their information being at risk.

Similarly, some more severe payment processors, such as PayPal Pro, require your membership site to be fully PCI compliant in order to accept payments using the payment processor. This makes it even more important to do your own research and know precisely what security measures you need to put into place before accepting payments on your membership site using your desired payment processor.

#5. Integrations

Since you’ll also be using a membership plugin to create and run your membership site, it’s essential that the payment processor of your choice also seamlessly integrates with your membership plugin.

This ensures that your membership site will work appropriately while securely accepting users’ payments. As a result, you can create a more seamless and friction-free registration and payment experience on your membership site.

Best payment processors for membership sites

Let’s take a look at some of the best payment processors for membership sites, so it’s easier for you to decide on the right one for your business.

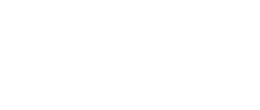

1. Stripe

Stripe is one of the most popular payment processors available that also works great with all types of membership websites.

Stripe integrates with most WordPress membership plugins and can help you offer a smooth payment experience on your membership site. Thanks to Stripe Subscriptions, you can also offer recurring payments and let your audience subscribe automatically to your membership site each month.

Pricing – Stripe charges 2.9% + $0.30 per successful card charge or transaction you process on your membership site.

2. PayPal

Another popular and widely used payment processor, PayPal, is one of most businesses’ most trusted and “go-to” payment processors.

PayPal offers extensive compatibility with most membership plugins, so it makes it easy to integrate PayPal into your membership site without having to worry about integration issues. Since most users already use PayPal to pay for something they purchase online, it’s a great way to ensure members won’t have an issue subscribing to your membership plan.

Pricing – PayPal charges a 2.9% fee + $0.30 fee per transaction processed by them on your membership site.

3. Gumroad

Gumroad is a newer payment processor designed to cater to the payment needs of online businesses such as membership sites or online stores.

Other than being very intuitive to first set up and use on your membership site, the robust payment processor also lets you set up recurring payments. This way, users can opt-in to pay each month automatically or automatically get charged for their subscription plan without having to manually pay each month.

Pricing – The subscription fee for Gumroad is $10 per month, plus you pay a 3.5% + $0.30 fee per transaction processed by the payment processor.

4. Braintree

Braintree is owned by one of the most popular payment processors: PayPal, and offers unique payment features out of the box.

Using Braintree, you can accept payments through the most popular methods such as Apple Pay, Android Pay, Venmo, or PayPal. This is the perfect solution if you’re looking to offer an easy way for mobile users on your membership site to make payments.

Pricing – If your membership site’s sales or payments are processed across $50,000, Braintree will charge a 2.9% + $0.30 transaction fee.

5. Authorize.net

Authorize.net is a professional payment processor that was first launched back in 1996.

Other than being intuitive to set up and use on your membership site, Authorize.net comes pre-built with a wide range of security features that help protect users’ payments. It’s one of the best solutions if you’re looking for a more severe payment processor that won’t have a problem processing larger sum payments securely on your membership site.

Pricing – You also pay the industry standard 2.9% + $0.30 transaction fee while paying a $49 set-up fee and a monthly $25 gateway fee.

Frequently Asked Questions

Q: What is a payment gateway?

A: A payment gateway is an online service that authorizes and facilitates online transactions, allowing merchants to accept customer payments through various payment methods like credit cards, debit cards, and digital wallets.

Q: Why is it important to choose the right payment gateway for my membership site?

A: Selecting the right payment gateway for your membership site is crucial as it determines how smoothly your payment process will run and affects the overall user experience. It can also impact the security of customer data and the ability to integrate with other systems or platforms.

Q: How do I choose the best payment gateway for my membership site?

A: When choosing a payment gateway for your membership site, consider factors such as transaction fees, integration options, supported payment methods, data security measures, availability of fraud protection, customer support, and the overall reputation of the payment gateway provider.

Q: What are some popular payment gateways for membership sites?

A: Some popular payment gateways for membership sites include PayPal, Stripe, Authorize.Net, 2Checkout, and Braintree. Each gateway has its own features, pricing structure, and integration options, so it’s important to compare them based on your specific requirements.

Q: What payment options should I offer on my membership site?

A: It’s recommended to offer various payment options on your membership site to cater to different preferences. Common payment options include credit cards, debit cards, digital wallets (e.g., PayPal), and bank transfers. Assess your target audience to determine which payment methods are most popular for your niche.

Q: Can I use multiple payment gateways on my membership site?

A: It is possible to integrate multiple payment gateways on your membership site. This allows you to offer more payment options to your customers and can help ensure higher conversion rates. However, consider the additional complexity and potential integration challenges before implementing multiple gateways.

Q: What is PCI compliance, and why is it important?

A: PCI compliance refers to the Payment Card Industry Data Security Standard, which sets security requirements for businesses that handle credit card data. It is important to choose a PCI-compliant payment gateway to ensure the security of your customer’s credit card information and comply with industry regulations.

Q: Are there any monthly fees associated with payment gateways?

A: Some payment gateways charge monthly fees, while others may have no monthly fees but charge transaction fees instead. It’s important to compare the pricing structures of different payment gateways to determine which option aligns with your budget and expected transaction volume.

Q: What should I consider when selecting a payment gateway for my membership site?

A: When selecting a payment gateway for your membership site, consider factors such as ease of use, compatibility with your website platform, availability of plugins or integrations, customer support responsiveness, reputation, security features, and transaction fees.

Q: How can I ensure the security of online payments on my membership site?

A: To ensure the security of online payments on your membership site, choose a payment gateway that offers secure data transmission (e.g., SSL encryption) and complies with industry security standards. Consider implementing additional security measures such as two-factor authentication and regular security audits.

Q: Can I receive payments in currencies other than my local currency?

A: Many payment gateways support multi-currency payments, allowing you to receive payments in different currencies. This can be beneficial if you have an international customer base or offer products or services in multiple countries.

Conclusion

With so many options available for payment processors, it can be challenging to decide on the right one for your business. This is why you must consider important factors such as your brand’s revenue, the fees, and costs associated with using the payment processor, its subscription options, and security features to ensure a safe payment experience on your membership site.

Do you know any other essential factors to remember when choosing a payment processor for your membership site? Let us know in the comments box below.