A solid online payment system is essential for any business looking to sell products, online courses, memberships, and non-profits looking to receive donations. This way, you can accept payments or money from clients, learners, or donors.

Since we’re talking about making payments, your primary concern should be securely processing payments and ensuring they’re affordable for your business and your members. This makes it important to decide on a secure online payment system with low transaction fees.

In this post, we’ll go over the top 10 association online payment solutions so you can decide on the right one for your business.

#1. PayPal

PayPal is one of the most popular payment solutions designed for businesses of all sizes and individuals who want a quick way to process their payments.

PayPal seamlessly integrates with most eCommerce platforms and makes it easier to accept payments from your subscribers or customers. This way, you ensure that your association is always prepared to manage payments and receive money from clients.

The highly secure payment solution also offers an intuitive way of managing funds for your business using an easy-to-navigate dashboard. You can use it to view all payment information and finances for your association from a single screen. In addition, the great thing about PayPal is that it offers robust security features such as fraud protection and transaction protection.

Pricing – PayPal charges a 3.49% + $0.49 fee per transaction when accepting online payments.

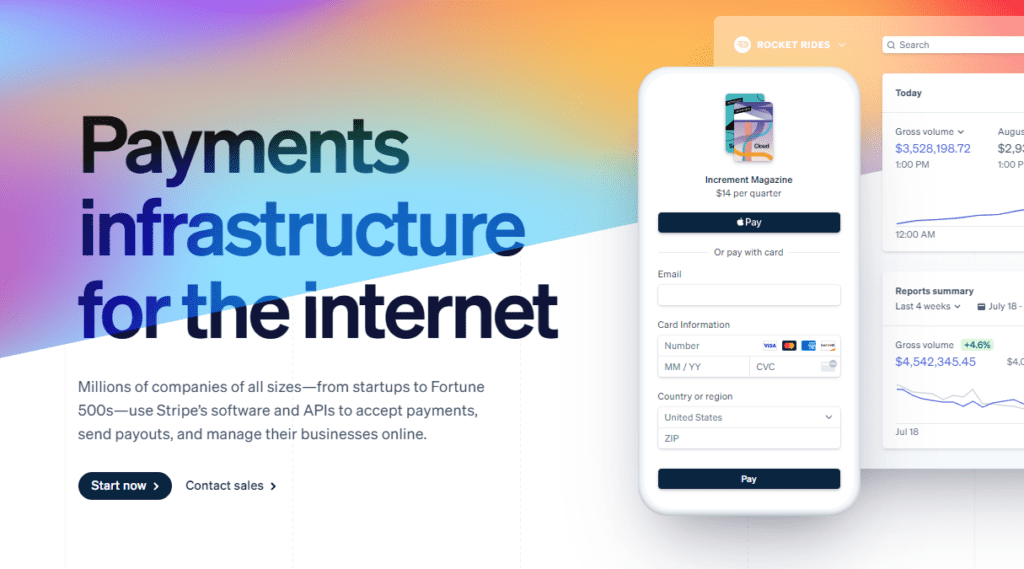

#2. Stripe

Stripe is another popular and widely used payment solution designed for businesses and organizations looking for a professional payment processor.

Despite the type of association, Stripe lets you accept payments from all channels, including eCommerce sites, subscriptions, or a marketplace in which your business operates in. The great thing about Stripe is that it’s very simple to set up for your business and offers an easy way to start accepting payments from customers securely. You can create a full-fledged payment page and share it with users who want to buy from you within a few clicks.

In addition, Stripe supports more than 130 currencies and many payment methods to ensure you can accept payments from customers or clients despite the geographical location of your business.

Pricing – Stripe charges a 2.9% + $0.30 fee for every successful transaction made using the platform.

#3. Authorize.net

Authorize.net is a fairly simple yet powerful payment solution designed to help associations and organizations easily accept all types of payments from customers or clients.

The robust payment solution lets you offer your customers a wide range of payment options when shopping from your eCommerce site. Similarly, it also allows you to accept payments from mobile users. This makes it the perfect solution for easily managing payments on any eCommerce platform and makes it easier to cater to all types of customers, even users who want to make payments using their mobile devices.

Additionally, Authorize.net also offers point-of-sale functionality and seamlessly lets you accept in-person payments from customers who pay using their credit or debit cards. The best part is that you can just turn your phone or tablet into a quick and secure mobile point-of-sale system.

Pricing – Authorize.net’s monthly gateway fee is $25 plus a 2.9% + $0.30 transaction fee.

#4. Apple Pay

Apple Pay is probably one of the most widely recognized and well-built payment solutions for iOS devices.

While you want to offer payment methods for mobile users who don’t use iOS devices, Apple Pay makes it very simple to accept payments from users who only use Apple devices. Apple Pay can seamlessly integrate with most POS systems so you can accept payments from your customers in person. Similarly, you can accept payments from your customers online using Apple Pay, which works just like any other payment processor.

The best part about Apple Pay is its simplicity and ease of use, as well as the sleek, modern design it features. This is important for associations as they want a distraction-free way of easily overlooking all payment data and managing funds.

Pricing – Apple Pay doesn’t charge an additional fee on top of a normal credit card transaction fee. The credit card transaction fee is entirely dependent on the country in which your association operates.

#5. Square

Square is a complete, all-in-one payment solution for associations and organizations.

With Square, you can accept payments from all eCommerce channels, including your online store, in-person store, and social media. The robust payment solution comes pre-built with eCommerce functionality, making it very simple to start selling from a free online store. You can create payment links and send them to your customers to accept payments online without creating a website to accept payments. In addition, even if you already have a website, you can easily add Square to accept payments from your clients securely.

That’s not all; Square also lets you set up payrolls for your team members or employees. This makes it the perfect payment solution for managing all payment data for your business as well as for paying employee salaries.

Pricing – You can get started with Square for free.

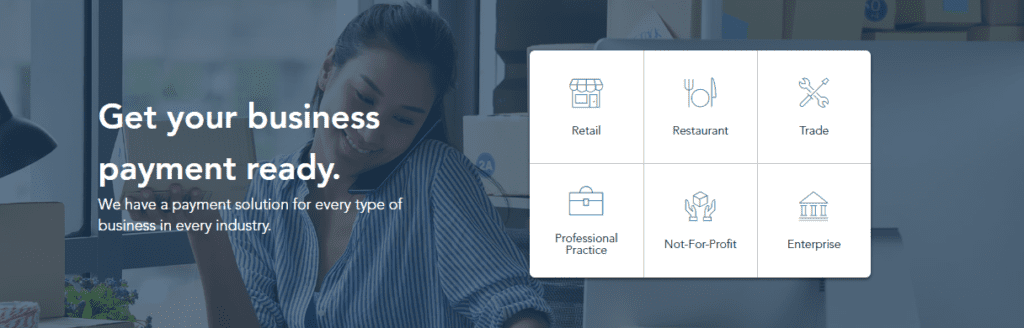

#6. Moneris

Moneris is another great online payment solution for associations and businesses that want to easily receive contactless payments from clients or customers.

Moneris offers a “hands-off” approach to setting up payments for your association and takes care of all everything so you can quickly start accepting payments from your customers and focus on running your business. The professional payment solution also features top-notch security features that help your business offer PCI compliment payment solutions to clients or customers.

In addition, the great thing about Moneris is that it has one of the best support teams in the game. This way, you don’t have to worry about getting stuck with bugs and issues as the support team is available 24/7 by phone call, live chat, and social media to help you quickly reach out to the experts.

Pricing – Moneris charges a 2.6% + $0.10 fee per transaction processed using the platform.

#7. Fundly

Fundly is a full-fledged online payment solution for non-profit organizations and associations looking for an easy way to accept donations.

Fundly features robust functionality that lets you create an effective non-profit donation campaign for your organization and helps you reach out to more donors so you can raise more finances or donations. You not only have the option to set up a donation campaign but also have access to guides that can help you grow your campaigns and reach more donors.

Fundly also gives you complete control over how your donation page looks so you can customize it according to your brand requirements.

Pricing – Fundly is free to set up but charges a 1.5% fee per donation plus a processing fee, depending on the donor’s payment processor.

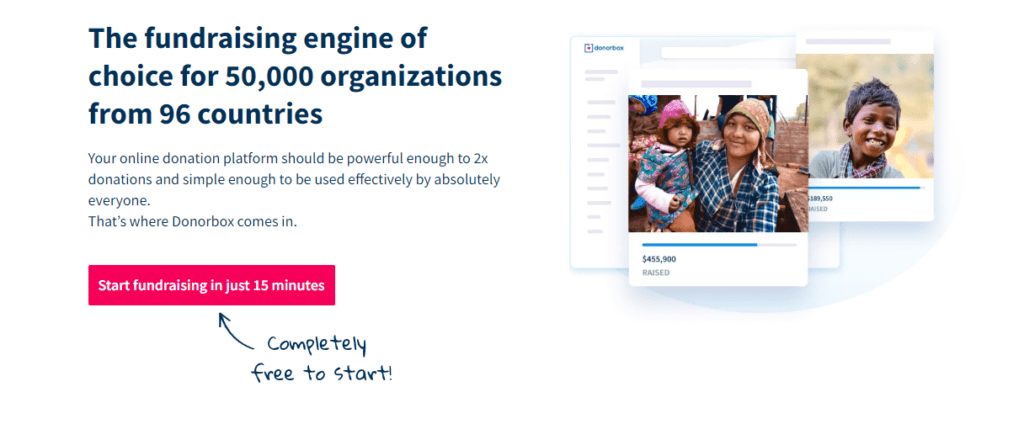

#8. Donorbox

Similar to Fundly, Donorbox is a payment solution designed to help your association reach more donors and raise more money for your cause.

Donorbox comes with many features and integrations that make it easier for organizations and associations to run fundraising campaigns. The platform supports more than 135 different currencies and over 10 languages, so it’s easier for your business to accept donations from donors all over the globe.

Pricing – Donorbox’s standard platform fee is 1.5% per transaction plus the standard payment processing fee of the donor’s payment process.

#9. WePay

WePay is owned by the popular US financial institute Chase and offers top-notch payment options for associations and businesses operating in the US, Canada, and the UK.

The online payment solution works great with most donation platforms, so your association can easily accept online donations. You can easily and securely process transactions and manage all finances, as it’s fully protected by WePay’s fraud and identity theft protection features.

Pricing – WePay charges a 2.9% + $0.30 fee per transaction.

#10. Due

Due is a modern, technology-backed online payment solution designed to help associations and businesses get paid faster.

With Due, you can securely process transactions that make it easier for your association to accept payments from your clients without having to worry about hackers or fraudsters. You also have access to tracking software, so you always know where your payments are.

Pricing – You can get started with Due for free but will have to pay the standard transaction fee, depending on the payment processor used.

Frequently Asked Questions

Q: What is the importance of online payment solutions for nonprofits?

A: Online payment solutions provide ease of collecting donations, membership fees, and other forms of payment for nonprofit organizations. Nonprofits can streamline their payment processing, making it more convenient for their donors and increasing their fundraising capabilities.

Q: What is a payment processor?

A: A payment processor is a third-party service that allows businesses, including nonprofits, to accept credit and debit card payments. Payment processors securely process and verify a donor’s information and transfer the funds to the nonprofit’s bank account.

Q: What are the best online payment processors for nonprofits?

A: The top 6 online payment processors for nonprofits include PayPal, Stripe, Authorize.Net, WePay, Donorbox, and GiveGab. These options offer features such as low transaction fees, recurring donations, and integration with donor management software.

Q: What is a nonprofit payment processor?

A: A nonprofit payment processor is a payment processing service designed specifically for nonprofit organizations. It often offers lower transaction fees and alternative payment options, such as ACH payments, to help nonprofits save on costs.

Q: What is the significance of payment processing tools for nonprofits?

A: Payment processing tools help streamline payment processing and make it more convenient for nonprofits to receive donations and membership fees. These tools can include donation forms, custom payment pages, recurring donation options, and integration with donor management and CRM software.

Q: What is PCI compliance and why is it important for nonprofits?

A: PCI compliance refers to the Payment Card Industry Data Security Standard, which ensures that businesses, including nonprofits, securely process, store, and transmit cardholder data. Nonprofits that accept credit and debit card payments must adhere to these standards to protect donor information and avoid costly fines.

Q: What are some payment types that nonprofit payment processors typically support?

A: Nonprofit payment processors typically support credit and debit card payments, as well as ACH payments, PayPal, and Apple Pay. Some may also support alternative payment methods, such as cryptocurrency.

Q: What is the monthly fee for nonprofit payment processing services?

A: The monthly fee for nonprofit payment processing services varies depending on the provider and the services offered. Many providers offer a free plan with no monthly fee, while others may charge a monthly fee starting at around $20 per month.

Q: What is the best nonprofit payment system?

A: The best nonprofit payment system will depend on the specific needs of the nonprofit organization. However, some of the most popular providers include PayPal, Stripe, and Donorbox, which offer low transaction fees, recurring donation options, and integration with donor management software.

Q: What is recurring donation and why is it important for nonprofits?

A: Recurring donation allows donors to set up automatic monthly or annual donations to a nonprofit organization. This is important for nonprofits because it provides a predictable stream of income and can help increase donor retention rates.

Conclusion

Online payment solutions allow associations and organizations to accept payments from their clients or donations online securely.

Ideally, you want to choose a solid online payment solution according to your unique business requirements and consider important factors such as transaction and platform fees, integrations, and security features when deciding on the final one.

Do you know any other great association online payment solutions? Let us know in the comments box below.